Universal Credit

Universal Credit is one of the main benefits Ukrainian visa holders who are below the state retirement age will be claiming. Here, we give more details on how this benefit works, how to apply, and things to be aware of.

If you have landed on this page first, we recommend you read through UK Benefits System first to get a good overview of the whole benefits system, as Universal Credit may not be the only benefit you are eligible for. You can find out how to use the benefits calculator, and how to apply for other benefits there also. There is also other important information on that page to be aware of, such as the overall Benefit Cap.

Please note: We are not benefits advisers and we are not giving benefits advice on this page. All figures are indicative; you must do your own calculations or have them done for you by appropriate professionals.

Content is currently mainly reflective of the situation in England, and variations may apply in Scotland, Wales and Northern Ireland.

On this page

- Universal Credit eligibility

- What does Universal Credit cover?

- How Universal Credit works (with scenarios)

- How to apply for Universal Credit

- Housing costs under Universal Credit

- Your Universal Credit journal

- Your claimant commitment

- Job Centre meetings

- Universal Credit payments

- Do you need to close your Universal Credit claim?

- Other circumstances where you can claim Universal Credit

- Where to go for further support

Universal Credit eligibility

You are potentially eligible to receive some level of support from Universal Credit if your total savings are under £16000 (either individually, or in a joint claim with your partner). You can receive full support if your savings are under £6000 and your earnings are low enough. Even if you go on to get a job, provided your savings don’t exceed £16000, you could still be eligible for Universal Credit and be able to get help with things like childcare and housing costs.

What does Universal Credit cover?

If you are entitled to Universal Credit benefits, you can get help with the following ‘elements’:

- Personal expenses – around £292 to £368 a month depending on age

- Help with housing costs (this won’t apply while living with a sponsor or family) – the maximum amount you can get depends on the area you are based in and your household details such as ages and genders of children. Rates can be found here: Local Housing Allowance – GOV.UK (www.gov.uk)

- Support for children – around £269 a month per child, or £315 a month for the first child if born before 6th April 2017. This is an allowance to help with the additional costs of feeding and clothing your dependent children

- Support for childcare costs if you are working – up to 85% of the cost, with a limit of £951 for one child, and £1630 for 2 or more children, that you can get back. Note that this refers to the cost of professional childcare through providers such as nurseries or childminders, which must be registered by the appropriate authorities such as Ofsted in England

- Support for yourself if you have limited capability to work e.g. due to disability, or for a child who is disabled

See: Universal Credit: What you’ll get – GOV.UK (www.gov.uk) for more details.

Any savings and income you have will reduce the total amount you are entitled to (property is unlikely to be included for Ukrainians). Your Universal Credit entitlement is worked out on your earnings after tax, national insurance, and pension contributions.

How Universal Credit works (with scenarios)

Universal Credit is designed to support people on low incomes effectively because it reduces gradually once you start earning. The idea is that even if your Universal Credit income reduces, it does so at a slower rate than your earnings increase.

So while, psychologically, it may be worrying to see your income from Universal Credit go down and even stop when you earn money, don’t forget to consider your total financial position, including your earnings. Overall, you are usually better off financially if you work, than if you rely on Universal Credit alone.

It is not the case that once you work for 16 hours, Universal Credit stops completely. That may have been true of older benefits systems. Depending on your circumstances, you can be working more, or less, hours before your Universal Credit ends. There’s no single answer.

If you are responsible for a child, or have limited capability to work, you get a ‘work allowance’ of £631 per month. This is the amount you can earn without any money being deducted from your Universal Credit entitlement as a result. If you get help with housing costs, the work allowance is £379 per month. Otherwise, you don’t get a work allowance at all.

For every £1 you earn over your work allowance, your Universal Credit entitlement is reduced by £0.55. This is an ‘earnings deduction’ (think of it like a ‘Universal Credit tax’ on your income). See https://www.gov.uk/universal-credit/how-your-earnings-affect-your-payments for a description.

Also, the savings you have above £6000 and below £16000 will reduce your Universal Credit entitlement as well. This is a ‘capital deduction’.

In the simplest scenario of a single person over the age of 25 staying with their hosts, with savings of less than £6000 (i.e. eligible for the maximum amount of Universal Credit), they will receive a standard amount of £85 a week from Universal Credit. They have no work allowance as they don’t have children or housing costs, so once they earn £154 a week, their ‘earnings deduction’ will be £154 x 0.55 = £85, which is the same as their Universal Credit entitlement, and their Universal Credit payment will therefore be zero. If they’re on £10.42 per hour, that’s only a total of around 14 hours work per week before it stops. But their total income is £154 (working), not £85 (Universal Credit alone), so they are £69 better off per week if they work.

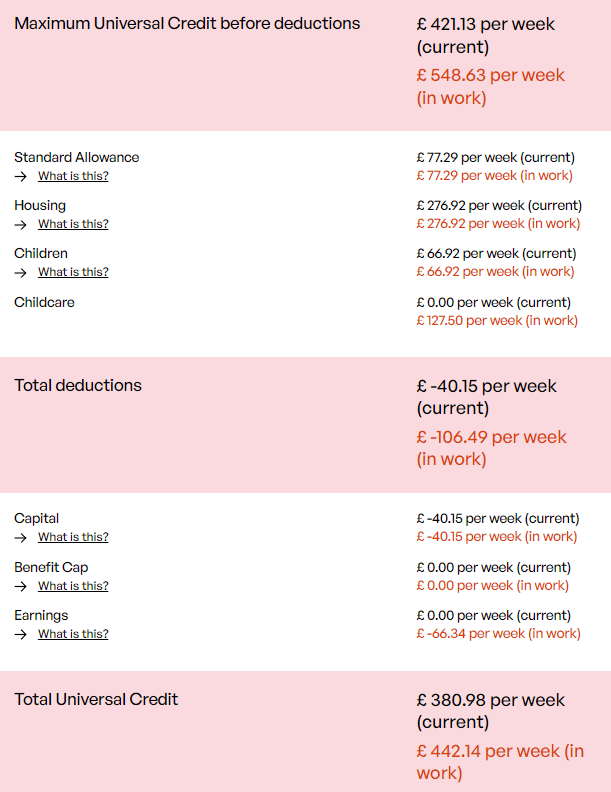

For a more complicated example, we put in 2 scenarios into Turn2Us benefits calculator (done in 2022 so using the rates from 2022):

- Not working (current; black colour), vs earning £200 a week (in work; red colour)

- 1 child aged 10

- Rent of £277 a week with a London postcode (£1200 a month)

- Childcare costs of £150 a week, when working (remember you can only claim childcare while working); Universal Credit pays 85% of this

- £16000 in savings (the upper limit to qualify for Universal Credit); capital deduction of £40 per week

The sceenshot shows the amount the benefits calculator shows you could get from Universal Credit for these 2 scenarios. Your income (i.e. earnings), and savings (i.e. capital), reduce your entitlement but it is not zero, due to the overall cirumstances.

In the scenario of not working, your total net income per week is: £381 from Universal Credit – £277 rent = £104

In the scenario of working, your total net income per week is: £442 from Universal Credit – £277 rent + £200 income from work – £150 childcare costs = £215.

The difference is clear. You’re better off working even with the expenses of childcare.

You can call these free Helplines for more information:

- Universal Credit Helpline: 0800 328 5644

- Turn2Us helpline: 0808 802 2000

- Citizens Advice Help to Claim number (England): 0800 144 8444 / Contact us about applying for Universal Credit – Citizens Advice. See Useful Contacts for equivalent numbers in other regions.

How to apply for Universal Credit

You can apply online for Universal Credit at the following link: Universal Credit: How to claim – GOV.UK (www.gov.uk)

You can also call:

- Citizens Advice Universal Credit Help to Claim number (England: 0800 144 8444. Interpreters can be arranged, just say ‘Interpreter Ukraine’, or you can have someone call on your behalf, you would just need to give Citizens Advice your consent for them to speak on your behalf. They can explain how Universal Credit works, what you are entitled to, and they can apply for you over the phone if you can’t manage it online. You can call this number to help you up until you get the first payment. See Useful Contacts for equivalent numbers in other regions.

You can use another person’s bank details such as your host’s to begin with, if you do not have a bank account as yet. Note that your benefit starts from the date you apply for Universal Credit, not the date you arrived in the UK, so do your application as soon as possible, don’t delay.

You may need to attend a Job Centre initially to provide proof of identity. Your appointment to attend will be sent to you once you have completed your online application. You should take all relevant ID such as passport, permission to travel letter etc. You can find your nearest Job Centre here: Jobcentre Plus Local Office Search – Gov UK (dwp.gov.uk)

Your money will take a few weeks to be paid. Universal Credit is typically paid every month, though it can be paid every 2 weeks in Scotland.

You can ask for an ‘advance payment’ if you need money immediately; this is a loan and your future payments will be adjusted to cover repaying this. In this case, you would need to call the Government’s Universal Credit helpline on 0800 328 5644.

Housing costs under Universal Credit

For the housing costs element of Universal Credit, note that the maximum amount you can get is known as the Local Housing Allowance rate and it depends on the details of your household and the local area where you are expecting to rent.

- Entering the details of your household at this link will firstly tell you the number of bedrooms you are eligible for

- Then entering the postcode where you are intending to rent and the number of bedrooms you are eligible for will tell you the maximum rent you are entitled to from Universal Credit according to the Local Housing Allowance for the area

You don’t need to actually rent as many bedrooms as you are eligible for. Typically you will find private rental rates will be higher than the Local Housing Allowance rate. For example, you might be entitled to a 2 bedroom rate of £1300, but in reality, this might only get you a 1 bedroom property; if the landlord agrees, you can rent a 1 bedroom property for £1300 instead and you will still be entitled to the rate for 2 bedrooms.

Unfortunately, you are only able to receive the help with housing costs from Universal Credit once you upload official confirmation that you are paying the rent, such as a signed tenancy agreement. However, if it turns out that you are eligible to receive help (as indicated by the benefits calculations), then even if you had to pay 6 months’ rent upfront to secure the property, Citizens Advice tell us that Universal Credit should still be liable for those costs for the first 6 months, and you can put in a claim for them.

Your Universal Credit journal

Once you have created an online Universal Credit account, you will have a ‘journal’ which tells you what you need to do and when. You can also report a ‘change of circumstance’ to change things such as adding in housing or childcare costs, or if you stop or start a new job. A list of things you need to report to Universal Credit is given here: https://www.gov.uk/universal-credit/changes-of-circumstances. You also need to report if you plan to go abroad / back to Ukraine.

Keep an eye on your journal, this is the main way you will communicate with your work coach and you can ask questions also if you’re not sure of something.

Use your benefits calculator account to check what will happen to your total benefits for any change such as taking up a new job, or starting to rent, and then update your Universal Credit account.

Your claimant commitment

Remember that if you are able to work, the benefits system is not a substitute for working. Your work coach will discuss with you what actions you’ll take to find suitable work, or to prepare for work, such as creating a CV or taking English classes. Here, being aware of the organisations that help you to find work will be useful, as you can mention that you’ll be contacting them as part of your commitment to find work.

The plan that is agreed is called your ‘claimant commitment’. It is something you need to carry out, or you risk being ‘sanctioned’, where your benefits are reduced or even stopped. Do not let this happen if possible.

Even if your work coach seems relaxed about you finding full-time work, we urge you to be aware of the difficulties in renting without this (see Renting Privately). After all, your work coach doesn’t need to worry about your housing arrangements, but you do.

See https://www.gov.uk/universal-credit/your-claimant-commitment for more details.

Job Centre meetings

You will meet your work coach at regular intervals, at their request. You can also ask to meet them. You are entitled to ask for an interpreter at your Job Centre meetings. Don’t miss an appointment without good reason, or you could get a ‘sanction’, which means that your benefits payments will be penalised.

Universal Credit payments

Universal Credit is clever enough to take into account variable earnings (which will be reported directly to DWP by your employer, or by you, if you are self-employed). So you can have periods where your earned income is more, or less, and have the flexibility to take on more work (remember to report changes of jobs to your work coach through your journal).

Universal Credit payments are based on ‘assessment periods’. When you get paid and how much, can depend on the region you’re in and how often your employer pays you. For more information, see for example, https://www.gov.uk/government/publications/universal-credit-different-earning-patterns-and-your-payments/universal-credit-different-earning-patterns-and-your-payments-payment-cycles.

Do you need to close your Universal Credit account?

If your Universal Credit payment is reduced to zero for a number of consecutive months, your Universal Credit claim will automatically be closed. However, your Universal Credit online account will remain open for 6 months, so that if you have a change of circumstances, and are eligible to receive Universal Credit again (such as renting somewhere), your claim can restart when you upload details of the change to your journal. If however, your Universal Credit online account is closed, you will need to apply for Universal Credit all over again.

Therefore, if the Job Centre tells you your claim is ending, check if your income might go down in the next few months, or if you might incur more costs, such as renting. If this is the case, ask them to keep your claim open.

Having an open claim, and receiving a little bit of money, can mean that you’re considered to ‘be on Universal Credit’ and therefore eligible for other types of help and discounts related to Universal Credit.

Other circumstances where you can claim Universal Credit

Apart from the typical scenario of someone aged 18 and above, who is expected to have a job, there are some other cases where it’s possible to claim Universal Credit. For example:

- Children without parental support aged 16 and 17 (i.e. who have not travelled to the UK with a parent)

- You’re studying or training full-time but are responsible for a child

- You’re aged under 21 and studying for A levels or equivalent and do not have parental support (note that university students are expected to take out student loans to support themselves – see Education)

- You’re self-employed – see https://www.gov.uk/self-employment-and-universal-credit

A full list of eligible situations is given here: https://www.gov.uk/universal-credit/eligibility.

Note that the online ‘benefits calculators’ cannot give accurate estimates for students, so it’s best to call the helplines in these cases. See https://www.gov.uk/guidance/universal-credit-and-students.

Where to go for further support

Once your claim is set up, call the Government Universal Credit helpline if you have queries or need to change appointments: 0800 328 5644. The equivalent number for Northern Ireland is 0800 012 1331.