Benefits for Ukrainian Refugees in the UK

The UK benefits system is designed to support people who:

- may need financial help while they look for a job, or if their income is low

- cannot work due to illness or disability

- are too old to work

These benefits are not loans (even if they are called ‘credit’), they do not have to be paid back, and if you are entitled to a benefit from the Government, then we encourage you to accept it, as refusing a benefit doesn’t help other people get money instead, it only harms YOU. Even if you are working, or a pensioner, and don’t think you will therefore get any help, you could still be eligible for more money than you realise. Being in the Universal Credit or Pension Credit ‘systems’ also enables you to automatically receive other help that the government may offer, such as one-off payments to help with the rising cost of living, help with healthcare costs like free eye tests etc, plus organisations like leisure centres may offer discounts to people who receive benefits. So it is worth checking your eligibility, as it is a gateway to a lot of extra help.

It is a complex area, and is one of the areas where we have found guests need a lot of support with. We are not benefits advisers and we are not giving benefits advice on this page. We have given only the main points below so that you have better awareness of what you can get help with and don’t miss out on the available financial support. For further information and support, we recommend contacting the various Government helplines mentioned, your local Job Centre, or charitable organisations such as Citizens Advice and Turn2Us, which can provide you with expert help and support for your particular case.

All figures mentioned are indicative, and we recommend starting by using a benefits calculator like the one provided by Turn2Us to learn about what you could be entitled to. It may also be helpful to ask someone to help you with the calculation, and to have them with you when you first visit the Job Centre or speak to someone on the phone.

Content here is mainly reflective of the situation for England, and variations may apply for Scotland, Wales and Northern Ireland. Benefits calculators should however work across all the regions.

On this page

- Eligibility of Ukrainian visa holders for benefits

- Key points around the benefits system

- Types of benefits – means-tested and non means-tested

- Benefits rates

- Working out what you are entitled to using a ‘benefits calculator’

- Where to get help and support

- Universal Credit

- Pension Credit

- Child Benefit

- Housing Benefit

- Council Tax Reduction / Support

- Disability Benefits and Carer’s Allowance

- Help with the cost of living

- The Benefit Cap – maximum amounts you can receive

- Do you need to pay tax on benefits received?

- What happens to your benefits if you visit Ukraine?

- Can you remain on benefits for the entire time?

- Summary table of benefits

Eligibility of Ukrainian visa holders for benefits

Ukrainians on the Family Visa, Extension Visa and Homes for Ukraine Visa schemes are entitled to apply for Government benefits from day one of arrival in the UK. See the following source for Government confirmation:

- Homes for Ukraine: https://www.gov.uk/guidance/apply-for-a-visa-under-the-ukraine-sponsorship-scheme – “You will be able to live, work and study in the UK and access public funds.” – where “public funds” refers to things such as the benefits system.

- Ukraine Family Scheme: https://www.gov.uk/guidance/apply-for-a-ukraine-family-scheme-visa – “You will be able to live, work and study in the UK and access public funds.”

- Ukraine Extension Scheme: https://www.gov.uk/guidance/apply-to-stay-in-the-uk-under-the-ukraine-extension-scheme – “You will be able to live, work and study in the UK and access public funds.”

- https://www.gov.uk/government/news/immediate-benefit-support-for-those-fleeing-the-invasion-in-ukraine – refers to Ukrainians being able to receive these benefits from day one of arrival

Receiving benefits will not impact your right to stay in the UK for 3 years under the Family Visa, Extension Visa and Homes For Ukraine schemes, nor will it impact any future route to settlement in the UK. If you hear such things, it may be in reference to other categories of immigrants, or just bad information.

Key points around the benefits system

The key points to note:

- You are eligible for Universal Credit or Pension Credit, if your savings and income are low enough. Property in Ukraine should be declared in your application, but is unlikely to count as an asset with value.

- Income also includes income from self-employment, and self-employed people can receive support from the benefits system

- With Universal Credit, you can get help with housing costs, cost of looking after your child and cost of paying for professional registered childcare, even if you are working. The idea is that you are overall better off working, than not working.

- If you stop receiving any money from Universal Credit after you start work, you can check and reapply for Universal Credit if your circumstances change, such as starting to rent, or paying for childcare

- If you qualify for Pension Credit, you can get help with housing costs through Housing Benefit when you start to rent

- Being on Universal Credit or Pension Credit gives you automatic access to some other benefits

- You can still get benefits if you have children or are disabled, even if you are not eligible for Universal Credit or Pension Credit. Note however, that you must pay tax on Child Benefit once you earn over £50000 and it’s effectively zero once you earn £60000.

- You could get help with the cost of living, even if you are not eligible for Universal Credit or Pension Credit

- You can get other types of grants from charities and local councils

- You can check what you are entitled to by using a ‘benefits calculator’ such as Turn2Us. Such calculators should take into account variations in Scotland, Wales and Northern Ireland (in particular, there is extra help available in Scotland).

See our summary section of benefits here.

Types of benefits – means-tested and non means-tested

There are two types of benefits:

- Those which depend on how much savings, income and property you have already (these are called ‘means-tested benefits’ as you are considered to have some ability or ‘means’ to support yourself).

- Those which don’t (these are called ‘non means-tested benefits’)

Means-tested benefits

The two main means-tested benefit systems are managed by the Government department called the Department for Work and Pensions (DWP). They are:

- Universal Credit – this is for people aged above 18 and below the state retirement age, who are generally expected to be able to work. It takes into account many situations, such as whether you have children to support, rent to pay etc. In some exceptional cases, younger people can receive Universal Credit too

- Pension Credit – this is for people at or above the state retirement age, who are not expected to work

(Other types of benefit that you may come across such as Jobseekers Allowance, Income Support, Working Tax Credit and Child Tax Credit are unlikely to apply to you; some of these are from systems that are being phased out.)

For Ukrainians, property in Ukraine should be declared but is unlikely to be taken into account when checking if you are eligible for these benefits. Savings and income that you can access are taken into account.

If you have no income, you are eligible to receive some level of support from Universal Credit if your total savings are under £16000 (either individually, or in a joint claim with your partner). You could receive full support if your savings are under £6000. Even if you go on to get a job, provided your savings don’t exceed £16000, you could still be eligible for Universal Credit and be able to get help with things like childcare and housing costs.

For Pension Credit, there isn’t a savings limit to qualify, but anything you have over £10000 will be taken into account, and will reduce your entitlement. You can also get help with housing costs through Housing Benefit if you are on Pension Credit, plus other benefits.

Non means-tested benefits

For these benefits, it does not matter what your situation is (even if you are working). You can still get these benefits, so it’s worth applying for them as well. It’s a separate process to apply for these.

- Child Benefit – worth £24 per week for the first child, and £15.90 a week for other children

- Disability Benefits – the exact type of benefit that is relevant depends on your age

Benefits rates

The benefits rates are updated at the start of every tax year (6th April). The rates for the 2023/2024 tax year that apply from 6th April 2023 are given here.

Working out what you are entitled to using a ‘benefits calculator’

We recommend you use a ‘benefits calculator‘ to work out what you can get, depending on your circumstances. This is a Government approved online tool that is designed to make it simple for you to understand what you will get, but it does not actually make any applications for benefits. Use this tool to check, even if you are working and don’t think you will get anything. After using this tool, you should know what you can then apply for and what you will get. (Note that we haven’t checked these tools extensively for different scenarios, nor confirmed how accurate they are, but they should be pretty good.) The tool will also explain if you have reached a limit in what you can claim (known as the Benefit Cap).

Turn2Us provides such a calculator and it has been adapted to take Ukrainian visa holders into account, so this would be a good one to use. Visit https://benefits-calculator.turn2us.org.uk/ and select ‘Benefits calculator’ to begin. Other benefits calculators are listed here: https://www.gov.uk/benefits-calculators.

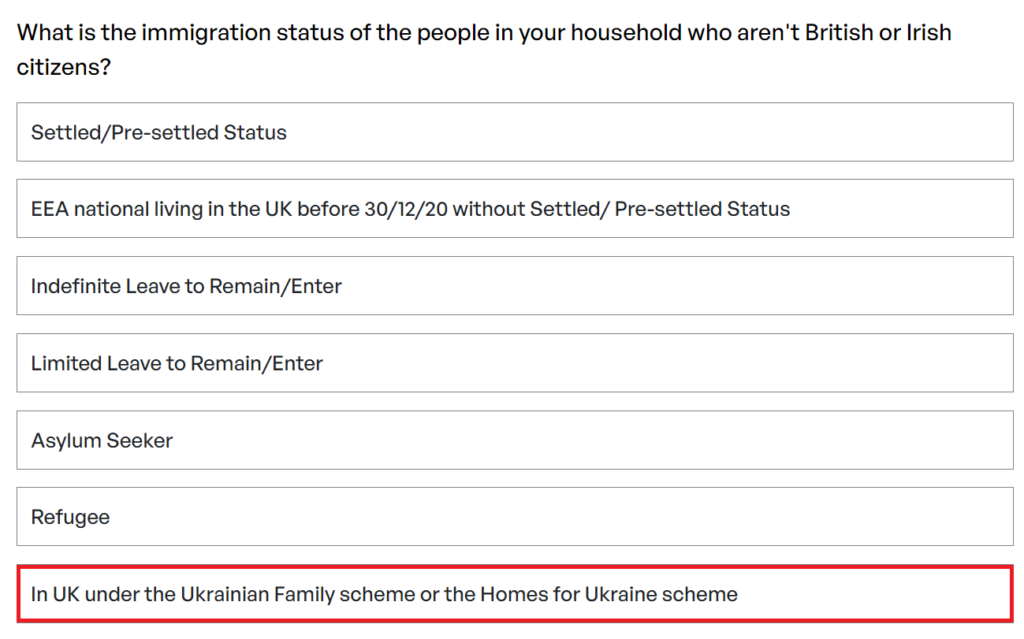

Answer ‘No’ if it asks you if you are a British citizen and select the following option (also applies if you are here under the Ukraine Extension Visa scheme):

Next, answer the other questions which are relevant such as questions about children or disability.

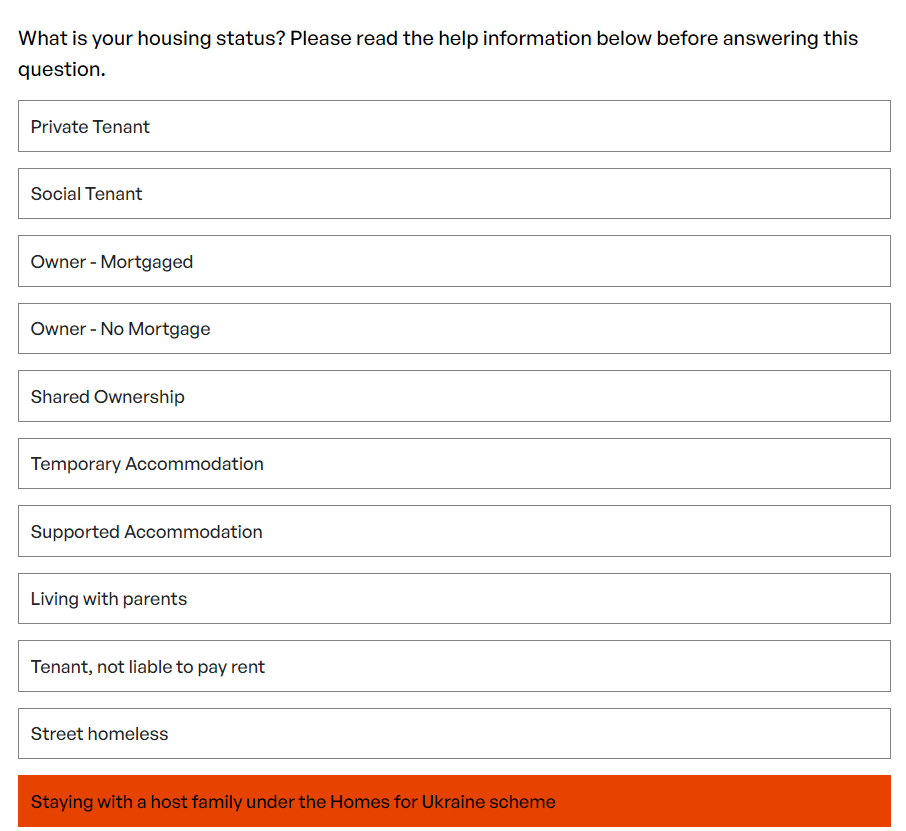

For the ‘Housing status’ question:

- If you are still living with your host under Homes for Ukraine scheme, select the option highlighted below. (It will remind you that hosts are not supposed to charge you rent.)

- If you are living with your relative under the Family Visa scheme, select ‘Other’ (not shown below)

- Else if you are renting privately (or want to check what you are entitled to if you do), select ‘Private Tenant’. Note that in this case, you must enter the postcode of the location you want to rent at the start of the calculator, otherwise it won’t be accurate.

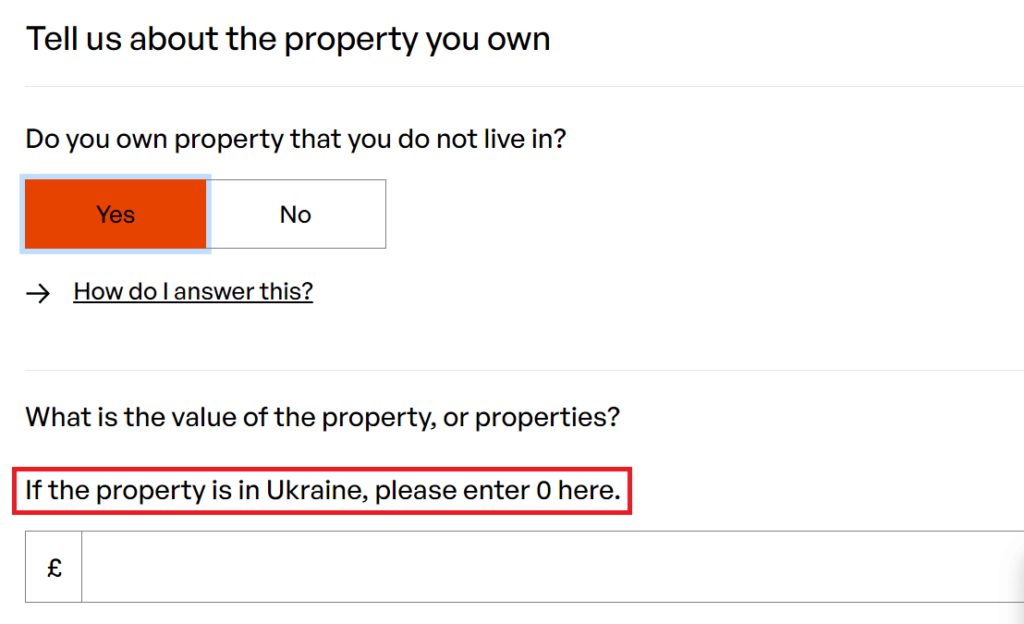

On the ‘Property’ page, you can see that Turn2Us says you should set the value of Ukrainian property you own to 0 (although we recommend you still declare it when you come to making the actual benefits application).

Note that each question has a helpful ‘How do I answer this’ or ‘Why is this information needed’ link you can click, so that you can understand what to write as your answer. Use this to avoid misunderstanding what you should put. There is a webchat function as well if you need help.

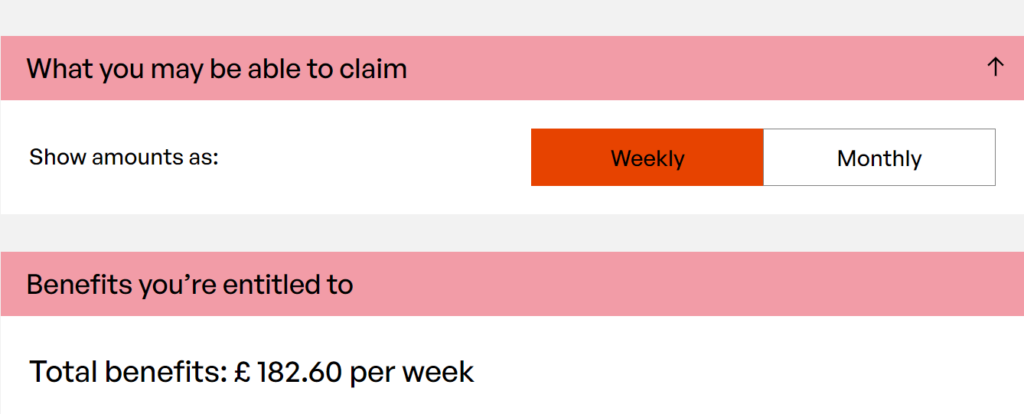

The results page tells you which benefits you are entitled to and how these were worked out. You can then go on to apply for them.

You can use the tool every time you want to check what happens to your benefits under different scenarios, such as getting a new job, or starting to rent somewhere. Each time you do a benefits calculation, you get a calculation reference number, so that you can refer to it again. The Government does not know what you enter here; it is private.

Where to go for help and support

If it’s difficult to use the benefits calculator, you can call Turn2Us on 0808 802 2000 (option 2) and ask them to complete it for you. They can provide you with an interpreter – say ‘Interpreter Ukraine’ for example. If you have already done it online, you can give them your benefits calculation reference number so they can check it for you. You can also use their webchat to ask questions about your calculation results. Their webchat is very responsive.

In England, you can also call Citizens Advice Help to Claim phone number (for Universal Credit only): 0800 144 8444.

The Citizens Advice Help to Claim number to call if you are in Wales is 0800 024 1220.

If you are based in Scotland, you can call Citizens Advice on 0800 023 2581; they can help you with Universal Credit, but will also be able to tell you about other kinds of benefits specific to Scotland that you may be eligible for, such as Scottish Child Payment.

If you require an interpreter, let Citizens Advice know when you call, and they will arrange a callback with a translator on the call.

For general benefits advice, you can find your local Citizens Advice branch here: Search for your local Citizens Advice – Citizens Advice. You may need to make an appointment to speak to someone in person.

Other organisations that could help if you contact them are those that have written other benefits calculators such as EntitledTo, and charities such as Age UK (for older people). It is perfectly normal for charities to provide support to people in the UK; and different charities have different specialisms and knowledge.

If you feel something doesn’t seem right or fair, for your circumstances, then speak to Citizens Advice about this as they may be able to help you in understanding or challenging a decision. Don’t give up because it seems too hard!

Universal Credit

If you are entitled to Universal Credit benefits, you can get help with the following:

- Personal living expenses

- Help with rental housing costs (this won’t apply while living with a sponsor)

- Support for children’s living expenses

- Support for professional childcare costs if you are working

- Support for yourself if you have limited capability to work e.g. due to disability, or for a child who is disabled

As this is quite a complex benefit to understand, we have provided more details on a dedicated page, including how to apply. See Universal Credit.

Pension Credit

Refugees who have reached the state retirement age in the UK can claim Pension Credit (this could be worth up to around £200 a week for a single person). Use the Government calculator at this link to enter your date of birth and to see whether you qualify for Pension Credit yet agewise (do not confuse it with State Pension). The age can be different for different people depending on their date of birth and your gender, but is around 66 or 67. If you are eligible, Pension Credit can be backdated to the date you arrive in the UK (up to a limit of 3 months). You can apply for Pension Credit 4 months before you reach the qualifying age.

Note that if you were a pensioner in Ukraine, but are aged under the state retirement age in the UK, you will not be able to receive Pension Credit; you will need to apply for Universal Credit instead and will be expected to take up work.

If you have savings and a pension income being received in Ukraine, this can affect the amount you are entitled to. Property is unlikely to be taken into account for Ukrainian refugees, although it should still be declared. You just need to declare truthfully any pension income being received which you can still access; you don’t need to provide proof. If you no longer get any Ukrainian pension because you used to collect it in person in cash at a Ukrainian Post Office, you could explain when claiming that this income is no longer coming to you and confirm that it probably doesn’t need to be included.

If you care for young children or another adult, the amount you get can change. You can also get extra help if you are disabled and there are no other adults living wth you.

See: Pension Credit: What you’ll get – GOV.UK (www.gov.uk). Also see the below screenshot from Turn2Us benefits calculator (done in 2022):

If you have £10,000 or less in savings and investments this will not affect your Pension Credit. If you have more than £10,000, every £500 over £10,000 counts as £1 income a week. For example, if you have £11,000 in savings, this counts as £2 income a week. See https://www.gov.uk/pension-credit/eligibility.

Age UK (a charity that helps older people) has a description of Pension Credit here: https://www.ageuk.org.uk/information-advice/money-legal/benefits-entitlements/pension-credit/

How to apply for Pension Credit

See Pension Credit: How to claim – GOV.UK (www.gov.uk) for details on how to apply. Applying online does not work for Ukrainian visa holders, as this method assumes you have already applied for a State Pension, which is not relevant to you. The State Pension is not the same as Pension Credit. Apply for Pension Credit by phone on 0800 99 1234. If needed, you can also apply for Housing Benefit as part of the claim.

The equivalent number to call if you live in Northern Ireland is 0808 100 6165.

You are recommended to have your National Insurance number (see National Insurance Number) when applying, or if you do not have one yet, you will receive one as part of your application. You will be sent an email where you can respond with documents such as your Permission to Travel letter and passport.

You can also contact Age UK on 0800 055 6112 for further help and support.

Child Benefit

Provided you, or your partner earn less than around £60000 a year, you are eligible to receive Child Benefit for children aged under 16, or up to 20 if they stay in approved further education or training. You can get this in addition to the money you receive for children if you are on Universal Credit, and you can get this even if you are not on Universal Credit, so make sure you apply for it. A benefits calculator will tell you if you qualify for this.

Note that this is a different system to Universal Credit and is a separate application process. It is administered by the Government department called HMRC (His Majesty’s Revenue and Customs).

See: Claim Child Benefit: What you’ll get – GOV.UK (www.gov.uk).

You’ll receive the maximum amount possible – £25.60 per week for the first child, and £16.95 per week for each additional child – if you (and your partner) each earn £50000 or less. Importantly, however, if one of you earns over £60000, that person is liable to pay the High Income Child Benefit Charge, which is a tax paid to HMRC. This means that you start to lose some of the benefit gradually after £50000, such that by the time you earn £60000, it’s reduced to zero.

You can estimate how much tax you’ll need to pay using the Child Benefit tax calculator, and you’ll need to pay any tax owed by registering for a self-assessment tax return.

The application can be backdated to the date you arrive in the UK (up to a limit of 3 months).

How to apply for Child Benefit

You will need a National Insurance number as a parent before you can apply. Applications are done by post, and you are asked to send the originals of documents such as your child’s passport and birth certificate (if you have it). Send the documents by Royal Mail Signed For service; it is pretty safe to do this and the documents should not get lost. They will be returned to you afterwards. If you are worried about sending the originals, you can take your documents to a Job Centre and they will make certified copies for you, which you can send instead and which will be accepted. Check before you travel to a particular Job Centre, whether they can do this, as not all Job Centres offer this service.

See: Claim Child Benefit: How to claim – GOV.UK (www.gov.uk)

You can phone the HMRC Child Benefit helpline on 0300 200 3100 if you have any questions.

Housing Benefit

Under certain situations, you can get a benefit called ‘Housing Benefit’.

If you receive Pension Credit, you can also apply for Housing Benefit as part of your Pension Credit claim. This would be the case for Ukrainians who have reached the state retirement age and who need to rent their own place soon after arrival in the UK. Otherwise, if you have been living with family or with a sponsor, then once you need to rent, you can apply for Housing Benefit using the link given below.

If you are eligible for Universal Credit and need to rent your own accommodation, you can already get help with housing costs using your Universal Credit account. You don’t apply for Housing Benefit separately. (However, if your local council has had to find you ‘temporary accommodation’ because you would be homeless, you will not claim any housing costs under Universal Credit. You would need to claim Housing Benefit instead to pay for the accommodation.)

The maximum amount that is paid under Housing Benefit (and these rates also apply for housing costs under Universal Credit) is called the Local Housing Allowance. If you work, the amount you get may be less than this. To find out what the rate is for the area where you intend to rent, enter a postcode in the area and your household details here: Local Housing Allowance – GOV.UK (www.gov.uk)

How to apply for Housing Benefit

Housing Benefit: How to claim – GOV.UK (www.gov.uk) – apply if you are on Pension Credit or in temporary accommodation arranged by the council that you need to pay for.

You will be directed to apply through your local council when you enter your current postcode on this page: https://www.gov.uk/apply-housing-benefit-from-council

Council Tax Reduction / Support

When you are ready to rent your own place, you are required to pay a tax called Council Tax, which covers the cost of the local council services such as street cleaning, rubbish collection etc. Let the council know the date you moved into your own property to avoid them charging you prior to this.

If you are on a low income, or on benefits, you can get help with paying this tax, called Council Tax Reduction (or Council Tax Support). A benefits calculator can tell you if you qualify for this. The help you can get will vary from council to council, so when using the benefits calculator, make sure you have put in the postcode of the area you think you are going to move to.

You apply for this benefit to your local council, not the Government. See here: Apply for Council Tax Reduction – GOV.UK (www.gov.uk).

IMPORTANT: In England, if everyone in the rented accommodation is a Homes for Ukraine visa holder, you are entitled to a discount of 50% on your bill in the first place. See https://ukrainianrefugeehelp.co.uk/moving-into-your-new-home/#help-with-council-tax for details. This discount does not apply to Wales or Scotland. However, note that when you move to the Ukraine Permission Extension visa scheme, this discount no longer applies.

Disability Benefits and Carer’s Allowance

There are different types of disability benefits depending on your age. They are described here: Financial help if you’re disabled: Disability and sickness benefits – GOV.UK (www.gov.uk). The main ones in England are:

- Disability Living Allowance (DLA) – for children under 16

- Personal Independence Payment (PIP) – for people aged 16 to State Pension age

- Attendance Allowance – if you have reached State Pension age

Your support needs will be assessed, based on your own written assessment and a UK doctor’s report. Mental illnesses are also considered. For specific disabilities, charities such as Scope and Mind may be able to help you with the claims process.

You can also get a benefit known as Carer’s Allowance if you are a carer i.e. you spend a significant amount of time caring for someone which means you yourself are not as free to work full-time. Eligibility for this depends on your income, so is ‘means-tested’. The person you are caring for needs to be in receipt of a qualifying disability benefit.

Note that if you are eligible for Universal Credit as well, you should separately receive additional help based on your ‘limited capability to work’; similarly if you are eligible for Pension Credit, you can receive extra help if you are disabled and do not live with any other adults. You could also receive extra help through these benefits systems if you care for someone with a qualifying disability benefit.

Note that variations apply to disability and carer benefits in Scotland. For example, the Adult Disability Payment replaces the Personal Independence Payment.

This is a complicated area and we advise you to get in touch with the official helplines or Citizens Advice trained benefits advisers to seek help with the process for your particular circumstances.

Help with the cost of living

The Government recognises that with the rising cost of living, especially around energy bills, households may need some extra help. As a result, extra funding has already been provided, such as:

- £400 payment to every household for bills

- £650 payment for those on benefits such as Universal Credit and Pension Credit

See this link: https://www.turn2us.org.uk/Benefit-guides/Cost-of-Living-Support/What-cost-of-living-support-is-available for more information. Usually, these payments are automatically applied if you are eligible, either to your utility bill or your Universal Credit / Pension Credit accounts. From time to time, the Government may announce extra support.

The Benefit Cap – maximum amount you can receive

The Benefit Cap is a limit to the amount of benefits you can actually receive, even if your entitlement is more. It will be applied automatically to bring your benefits to within the capped amounts.

See https://www.turn2us.org.uk/Benefit-guides/Benefit-Cap/How-much-is-the-Benefit-Cap for more details. Benefits calculators such as Turn2Us include the Benefit Cap in their calculations.

The current cap is:

- £486.98 per week (£2,110.25 per month or £25,323 per year) for couples and lone parents in Greater London

- £423.46 per week (£1,835.00 per month or £22,020 per year) for couples and lone parents outside Greater London

- £326.29 per week (£1,413.92 per month or £16,967 per year) for single adults in Greater London

- £283.71 per week (£1,229.42 per month or £14,753 per year) for single adults outside Greater London.

Note that if you earn a minimum of £722 per month, the Benefit Cap shouldn’t apply. See https://www.turn2us.org.uk/Benefit-guides/Benefit-Cap/Am-I-affected-by-the-Benefit-Cap for more details.

Do you need to pay tax on benefits received?

See https://www.gov.uk/income-tax/taxfree-and-taxable-state-benefits for details on this.

You don’t need to pay tax in the UK on Universal Credit, Pension Credit, Housing Benefit and disability benefits such as Disability Living Allowance and Personal Independence Payment. You don’t need to pay tax in the UK on Child Benefit if your income is below around £50000. In these cases, you do not need to declare these benefits on a self-assessment tax return.

However, if you receive Carer’s Allowance, it is taxable. See https://www.litrg.org.uk/tax-guides/disabled-people-and-carers/caring-someone/tax-and-benefits-carers for more information on this.

What happens to your benefits if you visit Ukraine?

A common question is whether or not it is possible to leave the UK if you are claiming benefits.

Both Universal Credit and Pension Credit told us that it is possible to leave the UK for up to 4 weeks without needing to stop your claim. You should advise them of your plans e.g. by making a journal entry. If you are out of the UK for longer, then your claim will be stopped after 4 weeks, and you will need to put in a new claim when you return.

See Going Back to Ukraine for more details.

Can you remain on benefits for the entire time?

No; if you are a fit and healthy individual of working age, then, even if you have young children, you are expected to find work (some exceptions apply). The benefits system is not a substitute for work.

Summary table of benefits

The following table provides a summary of the key benefits described here.

| Responsible authority | Depends on savings and income ‘means tested’) Below state retirement age | Depends on savings and income ( ‘means tested’) State retirement age and above | Doesn’t depend on savings and income (‘non means tested’) | Doesn’t depend on savings and income (‘non means tested’) |

|---|---|---|---|---|

| Department of Work and Pensions (DWP) | Universal Credit Help with: – Personal costs – Housing costs – Limited capability to work costs (e.g. disability) – Child costs – Professional childcare costs – Child disability costs – Carer costs | Pension Credit Help with: – Personal costs – Disability costs – Carer costs If they have responsibility for a child: – Child costs – Child disability costs | Disability Benefits – Age dependent allowances | |

| His Majesty’s Revenue and Customs (HMRC) | Child Benefit – Standard payments per child | |||

| Local council | Housing Benefit – Only covers help with housing costs of ‘temporary accommodation’ arranged for you by the council | Housing Benefit – Help with housing costs | ||

| Local council | Council Tax Reduction – Help with council tax bill | Council Tax Reduction – Help with council tax bill |

Illustrations

The following illustration shows what a typical working parent eligible for Universal Credit, renting their own place trough a private landlord, and with no disabilities themselves or for their children, could get in terms of benefits.

Personal costs

Universal Credit standard allowance

Housing costs

Universal Credit housing costs up to Local Housing Allowance rate

Council Tax Reduction

Child costs

Universal Credit child amount

Universal Credit professional childcare amount (if working)

Child Benefit

The following illustrates what someone eligible for Pension Credit and renting their own place, with disabilities, might get in support.

Personal costs

Pension Credit allowance

Housing costs

Housing Benefit up to Local Housing Allowance rate

Council Tax Reduction

Disability costs

Pension Credit extra support

Attendance Allowance